Contents

The NFP report is arguably the most important fundamental data point for the US economy. So while interest rates changes also have a big impact on forex, it is important to note that they change as a result of the NFP report. Effectively, interest rates are lagging indicators of what is going on in the economy. The NFP report is more of a leading indicator of how healthy the US economy is. While this strategy can be very profitable, it has some pitfalls to be aware of. The market may move aggressively in one direction and thus may be beginning to fade by the time an investor gets an inside bar signal.

That will make you much more adaptable, and you will be able to adapt the strategy to almost any condition that may develop while trading the aftermath of the NFP report. Some traders like to wait 5-price-bars before drawing a trendline, while others might have experiences that tell them less or more is best. It also helps to place a stop-loss in case the price bar selected wasn’t the actual price pullback low. Cory Mitchell, Chartered Market Technician, is a day trading expert with over 10 years of experience writing on investing, trading, and day trading for publications including Investopedia, Forbes, and others. The market adjusts its price based on the actual news release of the NFP data. A few days before the actual release of the NFP figures, traders can get a forecast of what to expect from headline news events.

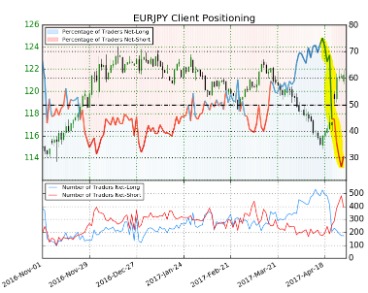

Chart of the day: USD/JPY

Go to the next lesson on Key factors that affect the forex markets. As with any aspect of currency trading, it is important to appreciate that no strategy is watertight when it comes to seeking trading opportunities from NFP data. The Federal Reserve has the mandate to maintain maximum employment in the US, as well as stable prices. So, they’ll pay close attention to the NFP when setting interest rate policy. If employment looks strong, the Fed may consider raising interest rates.

Traders need to consider other factors, such as market expectations and unanticipated uncertainties. Simply put, the NFP is an economic indicator of American employment. Non-Farm Payroll is a valuable economic information used to measure the number of new job additions during the previous month. For a day trade, an hour of work in a month is sufficient to trade the NFP release and prospectively get essential gains.

A trailing stop is an alternative if traders wish to stay in the trade. The strategy can be traded off of five- or 15-minute charts. For the rules and examples below, a 15-minute chart will be used, although the same rules apply to a five-minute chart. Signals may appear in different time frames, so remain consistent with one another. Data released on NFPs can be a catalyst for trade in foreign exchange trades based on changes in employment. However, there is one strategy that many traders seem to agree on.

Check an https://en.forexbrokerslist.site/ calendar to see when it is released if unsure. You’ll learn ways to make money trading actively, using a 1-minute chart and grabbing multiple trades. NFP is a key indicator of the US economic health, and the state of the economy is one of the major factors that move the stock market. When the economy is growing, investors are bullish on the stock market, and when the economy is in a decline, investors are bearish. Economic indicators are major economic events that are used to interpret investment opportunities in Forex trading. They usually are macroeconomic events that affect currencies and stock prices.

Active forex traders and successful traders experience a vast reduction in liquidity in the anticipation, which raises the risk and widens the spread. The headline number shows the number of added jobs to the US economy during the previous month, excluding farm employees, private household employees, and government jobs. To take the most advantage of the report, traders also need to follow the details of the report, including the average hourly earnings and the monthly unemployment rate. The unemployment rate shows the percentage of unemployed people during the previous month as a percentage of the total workforce. Just like with the other reports, a falling unemployment rate could support the US dollar, and a rising unemployment rate could send the US dollar down as Fed easing bets increase.

As we have our fundamental driver and a key technical level. NFP stands for Non-Farm Payrolls, which is actually part of the Employment Situation report, released by theBureau of Labor Statistics, an agency for the U.S. Learn how to trade forex in a fun and easy-to-understand format.

What are the non-farm payrolls and when they are released?

What’s more, a high https://forex-trend.net/ rate translates to much better economic strength. It’s not uncommon for the NFP to beat market expectations to a large extent, but the details to come in below forecasts. In this situation, algos and inexperienced traders will try to push the US dollar higher, but professional traders will use the higher prices to short the greenback at a more favourable price.

Also, higher inflation eats away at bond prices, so the prospect of rising price pressures is often negative for bonds. The explanation is not that simple, as the link between growth and inflation is complex. But at the basic level, high job growth causes a decline in bond prices. Apart from the monthly NFP reports, the Bureau of Labor Statistics is also responsible for releasing the US Consumer Price Index , which is used to measure inflation. These two elements — employment and inflation — are the key factors on which the US Federal Reserve bases its monetary policy decisions.

How to Use the NFP Report

Since the EUR/USD will not behave exactly the same after each NFP report, it will take some practice to be able to spot these trade setups and be fast enough to jump in and trade them. Waiting for at least a 5-price-bar pullback allows you to draw a trend line across the highs of the price bars or across the lows of the price bars. FXStreet and the author do not provide personalized recommendations.

Nonfarm payroll data and related statistics can also cause a domino effect, which, in turn, will further affect forex trading and market performance. When job gains accelerate rapidly, the Federal Reserve can relate this data to interest rate changes, potentially pushing through an increase or decrease depending on the circumstances. The reason traders choose to both acknowledge and scrutinize this data is that it provides a footing for identifying potential rates of inflation and the rate of economic growth. As a result, the NFP report is closely watched, particularly in forex markets, as there is a direct relationship between the level of job creation and interest rates. If jobs are strong and the economy is strong, interest rates will likely be rising. Conversely, weak jobs and low wages will cause the US Federal Reserve to cut official rates to help stimulate growth.

- Surprises and major changes in the released numbers can lead to significant price movements.

- The second period of persistently negative NFP numbers began in the second half of 2007, before the Great Recession and concluded in 2010.

- Investing involves risk, including the possible loss of principal.

- The wage inflation trend, job growth trend, and unemployment trend are by far more valuable than other month’s data.

In between trading stocks and forex he consults for a number of prominent financial websites and enjoys an active lifestyle. Many pros are around the 50% win rate with many of their strategies. It is the bigger wins relative to losses that create the profits. Trading the 1-minute generally provides multiple trades each day, whether around an NFP announcement or not. These are charts I post daily on Twitter following the trading day .

But you also need to consider these numbers within the context of the estimates going into the report. If the payroll increase amounts to 150,000 in a given month and estimates were only 100,000, this is a strong number. The payroll increase not only hit the ideal benchmark but also outperformed expectations.

Employment growth is usually favourable for the US dollar, because it translates into a lower unemployment rate and may create inflationary pressure in the economy. In turn, the Fed reacts to this phenomenon by raising rates, and higher rates are usually favourable for the currency. Published data are always compared to expectations that can be checked in the economic calendar on the xStation platform. Besides the non-farm payrolls, traders and investors also follow other job-related indicators that may also lead to increased volatility in the markets.

On the other hand, low wages and weak https://topforexnews.org/ result in a weak economic environment. After the release of the NFP report, the forex market underwent significant price movements. Should the unemployment rate decrease from one month to the next, this job growth makes the market undergo a consumption improvement. In the end, it leads to an increased Gross Domestic Product . If you decide to trade the actual news release, make sure to always use stop-losses and be prepared for large price movements immediately after the release. The volatility can often cause slippage and higher spreads, which are some drawbacks you need to pay attention to.

Because the NFP figure displays how many jobs have been added or lost in the sectors covered by the report, it is sometimes known as non-farm employment change instead of NFP. Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Investopedia does not provide tax, investment, or financial services and advice. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal. Generally, most movement occurs within four hours of the report’s release.